pa unemployment income tax refund

For more information on myPATH. The department may file a lien against your real and personal property for a fault overpayment.

Zip Code 19342 Profile Map And Demographics Updated March 2020 Coding Demographics Map

Unemployment compensation is taxable income which needs to be reported by filing an income tax return.

. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. A Treasury spokesperson said the average refund issued so far is about 63. Part-Year Residents of Pennsylvania.

Visit any of the tax type-specific pages provided on this page to. Click here to access your PUA dashboard and change your federal withholding status or access your PUA-1099G. You should receive a 1099-G reporting the unemployment compensation you received during 2021 to be reported on your 2021 Return in 2022.

Office of Unemployment Compensation Benefits UI Payment Services PO Box 67503 Harrisburg PA 17106-7503. If Line 13 is blank enter the amount from Line 12. Answer ID 402 Published 12032002 1215 AM Updated 05062022 1210 PM Unemployment compensation is.

The IRS will automatically refund. Record the your PA tax liability from Line 12 of your PA-40. Is unemployment compensation taxable.

Checks or money orders should be made payable to. To fill in Line 15 refer to the Eligibility Income Tables or Page 36 of the PA-40 tax booklet. All payments should be sent to.

Just waiting on the state refund now. MyPATH functionality will include services for filing and paying Personal Income Tax including remitting correspondence and documentation to the department electronically. You will also be able to review correspondence received from the department submit correspondence as well as communicate electronically with department representatives.

Submit Amend View and Print Quarterly Tax Reports. Pennsylvania does not tax unemployment compensation as income. - Personal Income Tax e-Services Center.

Record tax paid to other states or countries. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. UC Management System UCMS UC Tax Overview.

Normally any unemployment compensation someone receives is taxable. If you live in Pennsylvania and are receiving unemployment benefits from the state of Pennsylvania you will only be liable for federal income taxes on the benefits and not state income taxes. Harrisburg PA With the deadline to file 2021 personal income tax returns a week away the Department of Revenue is reminding Pennsylvanians that th.

Stimulus checks received IRS feds. It is included in your taxable income for the tax year. Make an Online Payment.

Just waiting on the state refund now. Initially Berrier said the total. You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent.

When you get laid off and make far less over the year you may get a large portion or all of your income tax withheld back as an unemployment tax refund. Your full name and Social Security number should be entered on the check or money order to ensure it is able to be processed. The Department of Revenue e-Services has been retired and replaced by myPATH.

What are the unemployment tax refunds. Enter the figures from your form on the eFile platform and the Tax App will calculate the taxes owed on. The IRS will continue reviewing and adjusting tax returns in this category this summer.

UCMS provides employers with an online platform to view andor perform the following. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. MyPATH allows the ability to register an account file returns pay balances and manage your account online.

Update Account Information eg. This tax form provides the total amount of money you were paid in benefits from the Office of Unemployment Compensation in 2021 as. Both federal and state law allow the department to intercept your federal income tax refund if your fault overpayment is due to under-reported or unreported earnings.

IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May. If filing as unmarried use Table 1. 56 people are eligible for payments between 5001 and 13500 totaling 353000.

While the federal government tweaked this rule in 2020 in response to COVID-19 those who collected unemployment income in 2021 should expect to pay the full taxes on those benefits. Subtract Line 13 from 12. AB Dates of June 17 2012 or later have a ten-year recoupment period.

You cant get that over-withheld income tax back until after the end of the year. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income.

COVID Tax Tip 2021-46 April 8 2021. Please share experiences for PA state refunds for those who filed and are still waiting many months later now. Taxes all taken cared of we had to pay a lot and I consider this just returning a bulk of the 300600 supplements like an interest free loan.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. This is the fourth round of refunds related to the unemployment compensation exclusion provision. Communication Preference Email or US Mail Addresses telephone numbers email addresses.

The amount of withholding is calculated using the payment amount after being adjusted for earnings in any. 1099-G Tax Form Information you need for income tax filing T he Statement for Recipients of Certain Government Payments 1099-G tax forms are mailed by January 31 st of each year for Pennsylvanians who received unemployment benefits. If the taxpayer is a pass-through entity the taxpayer would report an additional 31175 12500 federal income tax withheld plus 3825 employee FICA plus the 14850 refunded on the PA-20SPA-65 Schedule M as expenses that PA law allows that the entity could not deduct on its federal form.

Unemployment income Tax Refund. Taxpayers Can Use myPATH for PA Personal Income Tax Filing Prior to Filing Deadline N. If none leave blank.

Pa Department Of Labor Industry Palaborindustry Twitter

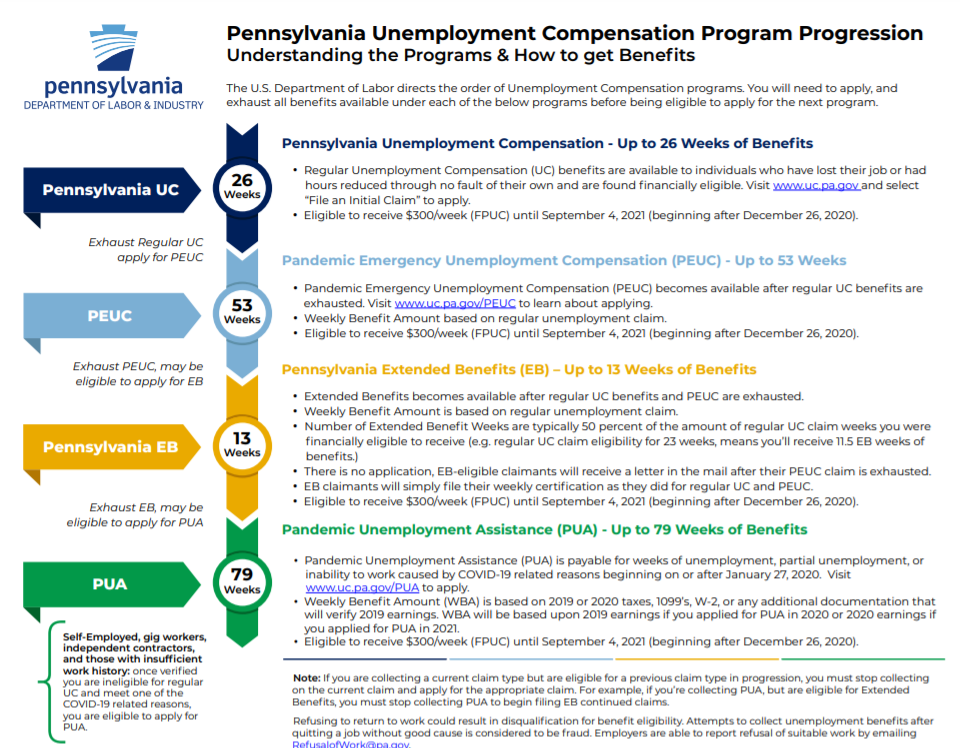

Pennsylvania Pa Department Of Labor And Industry End Of Enhanced Unemployment Benefits Under Pua Peuc Meuc And 300 Fpuc Programs Retroactive Benefit Payment Updates Aving To Invest

Pennsylvania How Unemployment Payments Are Considered

Learn About The Pennsylvania Dot S Car Registration Steps Forms And Fees Apply For A New Pa Vehicle Registration Ren Registration How To Apply Pennsylvania

Where S My Refund Pennsylvania H R Block

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania Employment Tax Tutorial

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania